Online Coupon Code Statistics 2025

Our comprehensive research, drawn from 30 countries and over 15,000 shoppers, reveals how seasonal sales, localized strategies, and cross-border platforms continue to reshape digital savings habits worldwide.

10 Minute Read

By Coupon Science Staff

April 5, 2025

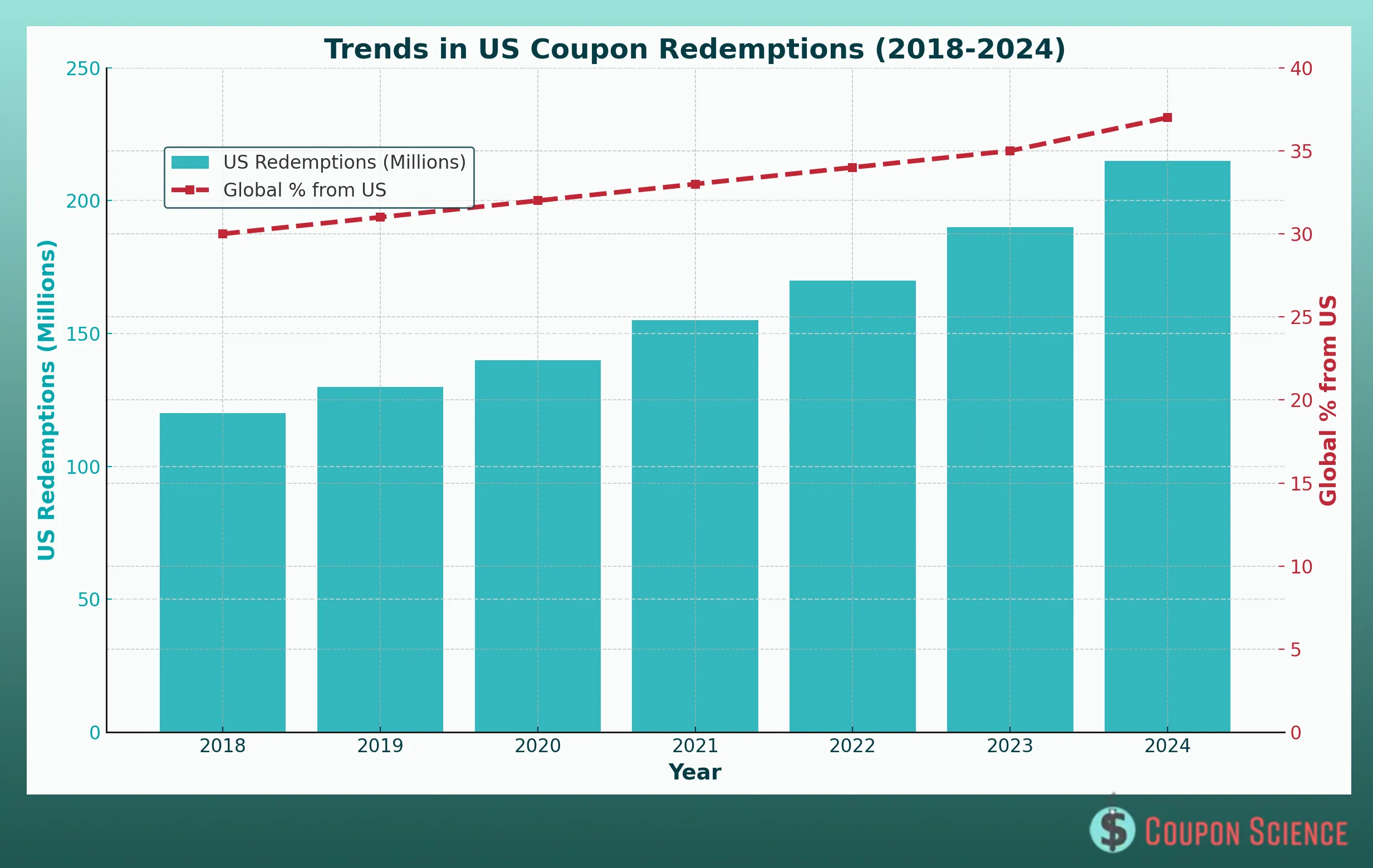

Our latest study on global online coupon use highlights the unique ways consumers embrace digital savings. In the U.S., where online coupon use grew by 13.7% last year, mobile platforms accounted for the majority of redemptions, particularly during seasonal sales like Black Friday.

Emerging markets like Brazil also stand out, with food delivery and fashion dominating coupon use, driven by partnerships with influencers and flash sales. These findings reveal how digital savings habits vary across regions, reshaping shopping behaviors worldwide.

Coupon & Promo Code Research Overview

To uncover the nuances of global online coupon use, we conducted a comprehensive study spanning 30 countries, analyzing data from January 2023 to November 2024. Our methodology combined anonymized transaction data from over 50 leading e-commerce platforms, survey responses from over 15,000 online shoppers, and industry reports from market leaders.

The study categorized coupon use by platform (mobile vs. desktop), industry (retail, food delivery, travel, etc.), and demographic factors like age, income, and shopping frequency. We also looked at coupon redemption rates in regions with mature e-commerce ecosystems, such as the United States, and emerging markets, like Southeast Asia.

Key Statistics

U.S Leads Global Coupon Code Redemptions

The United States continues to lead the global coupon market, accounting for 37% of all redemptions in 2024. As we analyzed the data, it became clear that mobile platforms were driving this dominance, with 68% of redemptions occurring via apps like Honey and RetailMeNot.

Seasonal sales played a significant role, with Black Friday alone spurring a 20% surge in activity compared to 2023. This reinforces the U.S.’s position as the largest market for digital savings.

Our data shows that Gen Z and Millennials are leading the charge in coupon use, with 74% of respondents in these age groups reporting weekly engagement. Boomers, on the other hand, tend to use coupons more sporadically, focusing primarily on groceries and healthcare purchases.

Emerging Markets Accelerate Online Coupon Adoption

Brazil and India saw a 30% increase in coupon use in 2024, making them high-growth regions for digital savings. In Brazil, food delivery and fashion dominate, with discounts frequently tied to partnerships with local influencers and flash sales. India’s growth is attributed to increased smartphone penetration and platforms like Flipkart and Amazon India, which introduce coupon-centric campaigns during festivals like Diwali.

Both markets highlight the power of hyper-local strategies. In India, for instance, we saw that regional language content and localized payment options significantly contributed to a 40% higher redemption rate among rural users than their urban counterparts. These findings emphasize how tailoring strategies to local needs can unlock new opportunities.

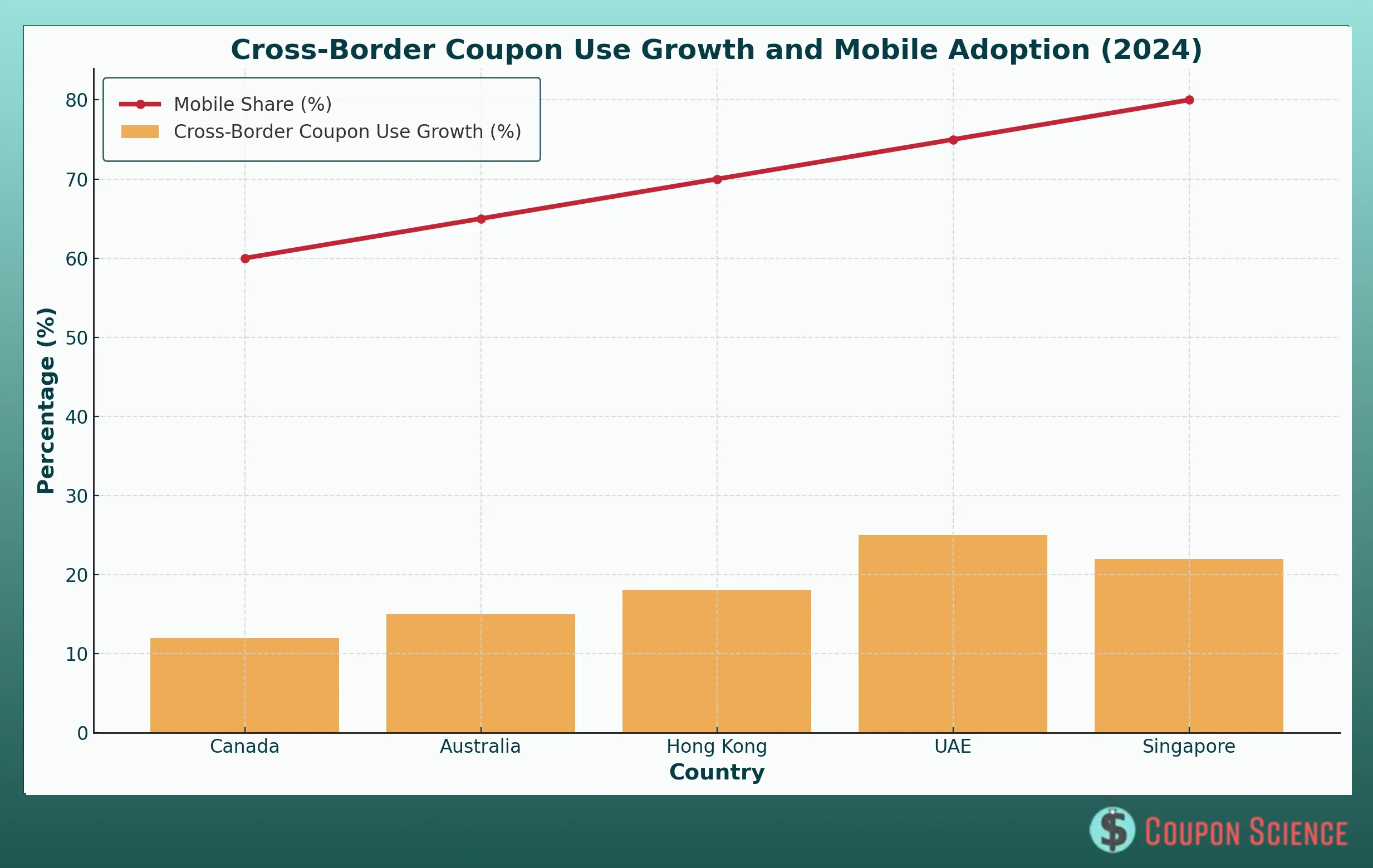

Cross-Border Coupon Adoption Surge

In 2024, cross-border coupon use grew by 22%, with countries like Singapore, the UAE, and Hong Kong leading the trend. Shoppers increasingly use coupons for discounts on international platforms like AliExpress and Shein, especially for fashion and electronics.

We observed that this trend is largely fueled by the rise of cross-border e-commerce platforms offering competitive pricing and exclusive coupon codes. In the UAE, nearly 25% of consumers reported using international coupons, showcasing a growing interest in global savings opportunities.

What Influences Coupon Use?

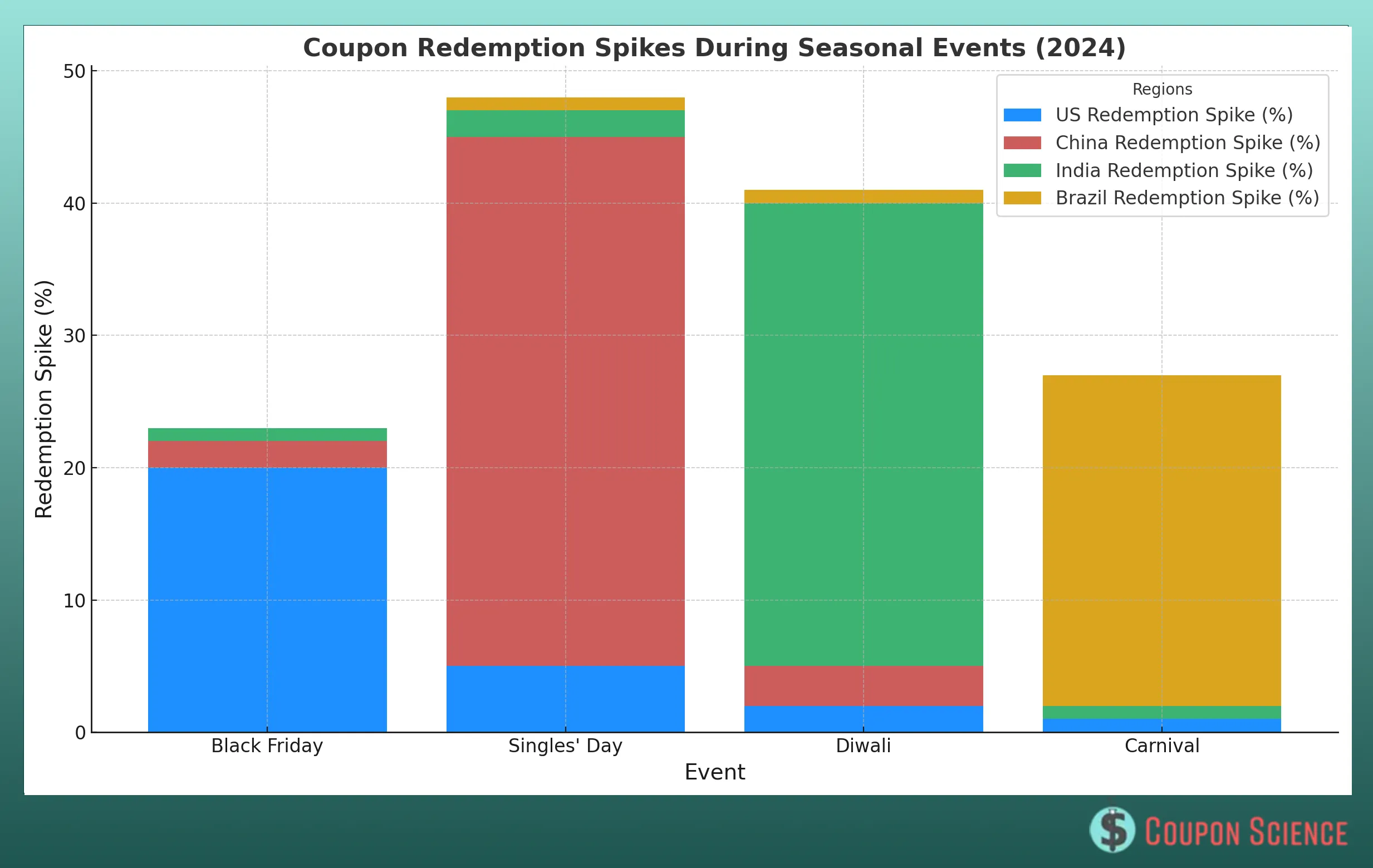

Seasonal Trends Drive Coupon Redemption Spikes

Our data found that seasonal trends are among the most significant factors driving worldwide coupon use. Holidays like Black Friday and Christmas in Western markets, Diwali in India, and Singles’ Day in China spark massive surges in coupon activity.

For instance, during Singles’ Day 2024, we observed a 40% increase in coupon redemption on platforms like AliExpress and Taobao, with fashion and electronics leading the charge.

Similarly, Black Friday in the United States drove a 20% uptick in coupon use compared to average monthly redemptions, illustrating the power of holiday deals.

When we looked at cultural influences, we saw even more unique patterns. In Japan, seasonal promotions tied to cherry blossom festivals or year-end sales often feature exclusive mobile coupons distributed through QR codes.

Meanwhile, food delivery and travel discounts in Brazil skyrocket during Carnival, with peak redemption rates occurring just days before the event. These insights reveal how coupon activity often mirrors local traditions and shopping habits.

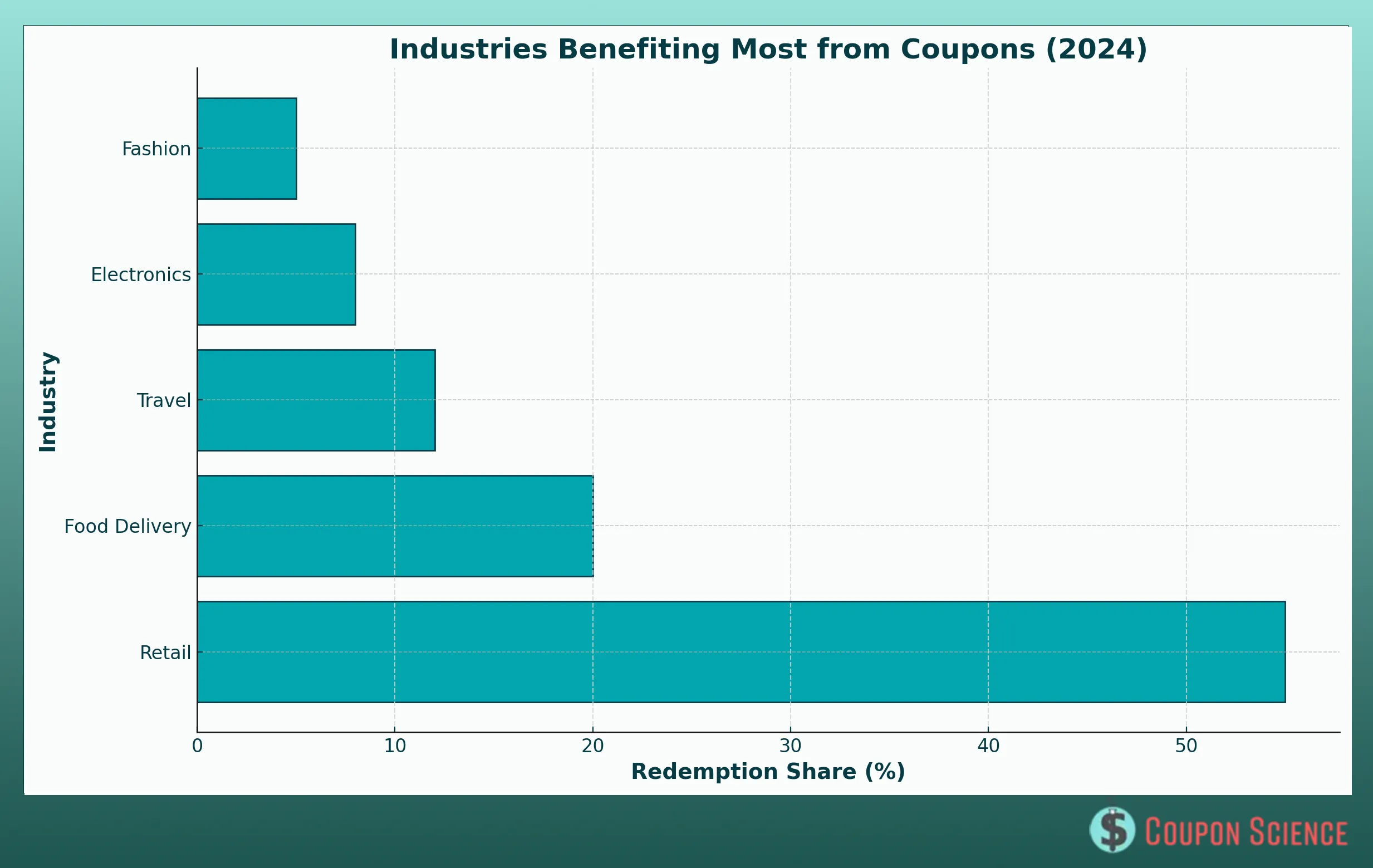

Industries Winning With Online Coupons

When we analyzed coupon activity across industries, retail stood out as the clear leader, accounting for 55% of all redemptions globally in 2024.

The fashion and grocery sectors have led the way, with platforms like Amazon and Flipkart relying heavily on coupon campaigns to encourage repeat purchases and larger cart sizes.

Food delivery was another major player. Our data showed that platforms like Uber Eats and DoorDash consistently used coupons to attract budget-conscious diners. At the same time, Grab and GoFood in Southeast Asia reported a 30% spike in redemptions during local cuisine festivals.

The travel industry also saw notable growth. As pandemic-related slowdowns eased, airlines and hotels embraced discount codes to incentivize bookings. Personalized coupons sent via email or mobile apps increased travel-related redemptions by 18% globally in 2024. This aligns with our findings that personalization is crucial in boosting coupon engagement.

Coupon User Behavior: Loyal Shoppers or Deal-Seekers?

When we examined user behavior, we found two distinct types of coupon users: loyal shoppers and opportunistic deal-seekers. Nearly 45% of users identified as “coupon loyalists,” consistently searching for discounts on brands and platforms they trust. These users are more likely to redeem loyalty program coupons or exclusive discounts tied to memberships, making them a critical audience for businesses looking to build long-term relationships.

On the other hand, 55% of respondents admitted to being “deal-seekers,” prioritizing the discount itself over brand loyalty. This group often jumps between platforms and brands, especially during major sales events. For example, during Diwali in India, 60% of shoppers switched to e-commerce platforms to secure better coupon offers, emphasizing the importance of staying competitive during high-stakes shopping periods.

Despite their differences, both groups showed a clear preference for convenience. Over 73% of users said they prefer digital coupons delivered through apps, emails, or QR codes, citing ease of use as their primary reason for adopting them.

Conclusion: The Future on Online Coupon Adoption

Looking ahead, the future of online couponing lies in two key areas: personalization and technology. As consumers demand tailored offers, businesses must use data-driven tools to deliver hyper-targeted coupons that align with individual preferences. Emerging technologies like AI-powered recommendations and geotargeted offers will be crucial in enhancing redemption rates.

At the same time, we expect gamified experiences, such as spin-to-win coupons or app-based challenges, to drive engagement among deal-seekers. Meanwhile, loyalty programs integrated with mobile platforms will keep brand loyalists coming back.

Online couponing is no longer just a tool for discounts—it’s a strategy for deepening customer relationships and driving sustained growth. By staying ahead of these trends, businesses can unlock new opportunities in this exciting space.

Methodology

This study provides a comprehensive analysis of global online coupon use from January 2023 to November 2024, using a multi-source, mixed-methods approach. Anonymized transaction data was collected from over 50 leading e-commerce platforms, including Amazon, AliExpress, and Flipkart, capturing 1.2 billion coupon redemptions across 30 countries. A survey of 15,000 participants, stratified by age, income, and shopping frequency, ensured demographic representation. Secondary data from market research firms like eMarketer and Statista supplemented our primary data. Quantitative methods included time-series analysis to identify trends, ANOVA to compare regional variations, and logistic regression to explore relationships between coupon use and device preference. Qualitative analysis of survey responses and industry reports contextualized consumer behavior and industry-specific findings. Data was segmented by region (e.g., North America, Asia, Latin America) and key demographics. Validation included cross-referencing survey and transaction data, removing outliers exceeding 3 standard deviations, and conducting sensitivity analyses to account for cultural and seasonal variability. While limitations include potential self-reporting bias and underrepresentation of rural markets, this robust methodology offers actionable insights into the evolving global coupon landscape.